It’s almost hard to recall just over a year ago when the front page of the BBC website was focused on stockpiling and panic buying, and our evenings were spent in long supermarket queues or refreshing websites to secure a delivery spot.

As predicted, stock levels levelled– and the supply chain, whilst strained, did not break. What has changed is how many of us now shop online for the things we used to travel to a store for and how the food and beverage sector has found its new niche.

The food and beverage industry had remained slow in its move to a Direct-to-Consumer (D2C) space, primarily due to consumers’ long-standing tradition of regular supermarket store visits and the lack of optimised online options. Despite that, recent statistics from IRI and Nielsen indicating that D2C will account for about 50% of the growth in sales of consumer packaged goods (CPG) in the US through 2025.

The pandemic changed this.

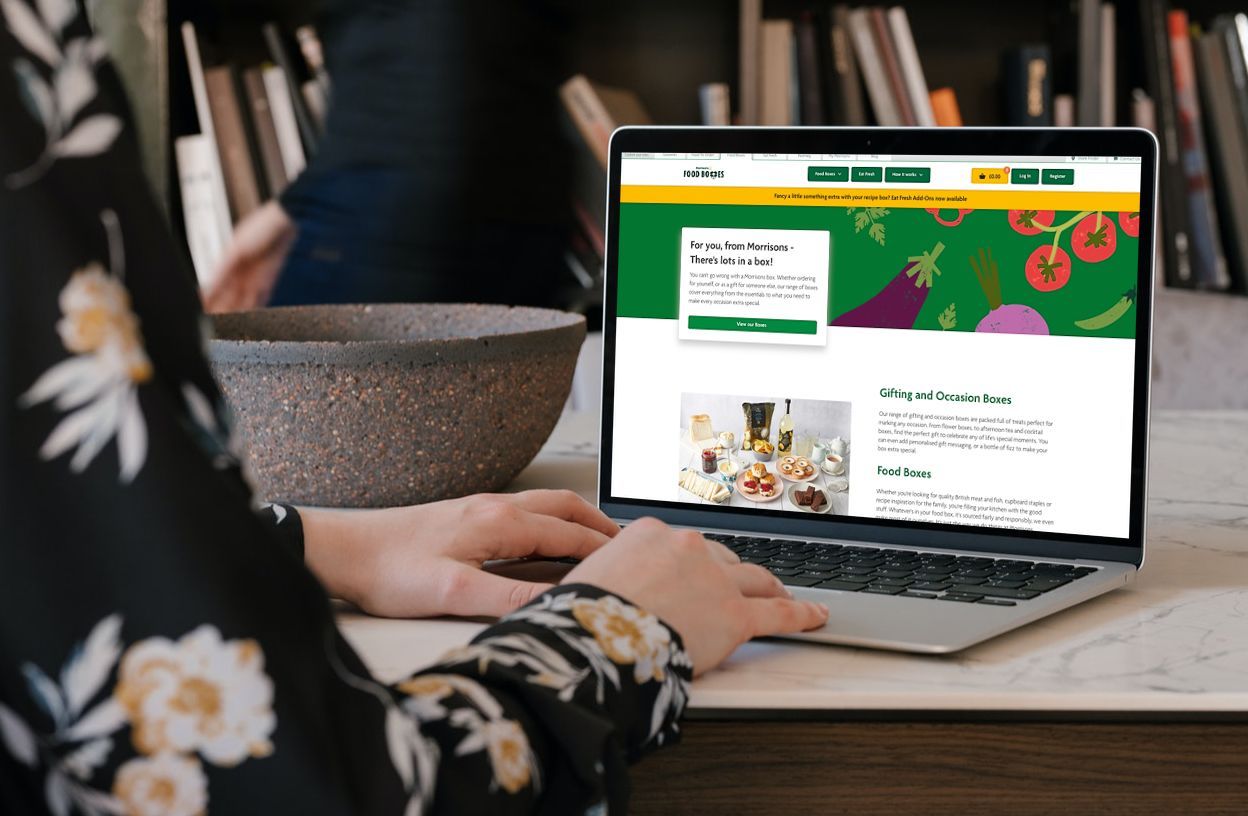

The message that it isn’t desirable didn’t hold weight – and as for speed, the fact that we delivered a direct to consumer offering for Morrisons in just six days (including a customer-facing website, pick & pack tech, integrations, CRM and ERP systems) showed it was possible.

The benefits for any food and beverage business selling D2C are vast, from improved speed to market, ownership of customer data and relationships and full control over the customer experience, as well as the ability to have a ‘customer for life’.

A new normal for customers

But is the appetite still there for direct to consumer as we move into ‘new normal’? Research suggests that it is, because the pandemic has changed people’s grocery and food purchasing habits entirely. If you wanted a fun night in with some drinks for that Zoom quiz, you might have turned to the brewer, who, usually stocking at a supermarket, now sold directly to you from their site or another web platform.

If you were new to online shopping and you managed to secure a coveted grocery delivery spot, the chances are, you have stuck with the same retailer. (According to a report from Blue Acorn ici, 75% of online food shoppers stuck with the first online store they tried, and that 87% of consumers finding products out of stock in physical stores are turning to digital channels to fulfil their product needs.)

The sector has changed

This is changing 3PL (third party logistics) in a big way, as orders switch from hefty pallets to individual, customised items, delivered not to the shutters of a store but direct to the door of a thirsty consumer. As a result, the logistics, delivery and web sectors are running completely different businesses than they were in 2019.

KitKat has its own D2C offering, the Heinz to Home portal came about last year, alongside other giants such as PepsiCo using D2C as a move to sustainability. For example, PepsiCo’s ‘Unwasted’ model sells obsolete products in boxes to the end consumer via a website from many PepsiCo brands, including Lay’s, Quaker and Dorito. While they started selling on food waste app, Too Good To Go, there was too much consumer demand to meet the stock – so an opportunity to sell D2C presented itself.

It’s certainly a thinking area for any food or beverage business wanting to decrease their food waste levels whilst also appealing to new customers.

Can you still make the most of the Direct to Consumer boom?

The early movers have had the advantage, but there is still a window of opportunity to attract and retain customers using D2C models.

Even if you are a brand that’s restricted on D2C through contracts with retailers, you may be able to launch a D2C channel with a new, innovative product line that retailers don’t carry. If you are mindful of not undercutting retail partners, this is an area you can experiment with.

While the pandemic brought quick and effective options for retailers feeling the pinch, such as the ability to offer online ordering, curbside pickup, and delivery, the next evolution in

D2C for food & beverage brands will be building on this technology to offer a more advanced business model.

Some call it the ‘Amazon effect’ – a nod to the eCommerce giant’s unrivalled customer experience.

For example, according to a recent study, over a third of consumers (36.9%) are interested in a food or drink subscription service, and 8.9% already use or have recently used one.

For predictable revenue, it’s unbeatable, and the customer gets their items ‘on tap’.

Should you switch to offering D2C?

The trend at the moment is to treat D2C as a complementary service alongside your traditional routes of sale. So while all the predictions point towards consumers continuing to search and shop online, these can’t offer 100% accuracy.

What we do know is that testing D2C right now is probably a very smart decision, based on what the world’s biggest brands are doing right now.

Work with Orderly, and you can get set up for success in record time, with

specialised eCommerce and pick and pack technology for food and beverage enterprises designed to increase sales and decrease production waste.

Integrate with any payment provider and a range of couriers, your customer service desk and customer relationship management tool, and keep that single customer view.

The Covid-19 crisis has caused major disruption in supply chains – but also a chance to reassess how things are done. If you’re ready to explore the next evolution, speak to us today.

Book in for a demo here.